The superyacht industry stands at a critical juncture in its journey toward sustainability, with alternative fuels like green methanol garnering significant attention as potential solutions for reducing emissions. At Peninsula, we support innovation and are committed to helping the sector advance toward a more sustainable future. However, as discussions around green methanol intensify, examining the current realities of production, supply chain challenges, and practical alternatives that can deliver immediate environmental benefits while the industry develops long-term solutions is essential.

Understanding the Green Methanol Landscape

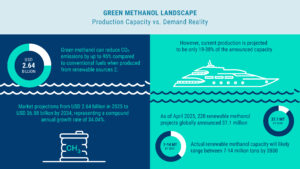

Production Capacity vs. Demand Reality

Green methanol represents a promising pathway for maritime decarbonisation, with the potential to reduce carbon dioxide emissions by up to 95% compared to conventional fuels when produced from renewable sources. The global green methanol market is experiencing rapid growth, with projections showing expansion from USD 2.64 billion in 2025 to approximately USD 36.88 billion by 2034, representing a compound annual growth rate of 34.04%.

However, the reality of current production tells a different story. As of April 2025, the Methanol Institute tracks 220 renewable methanol projects globally with a total announced capacity of 37.1 million tonnes by 2030. This includes 20.6 million tons of e-methanol and 16.5 million tons of biomethanol projects. Yet industry experts acknowledge that considering barriers and challenges in project development, actual renewable methanol capacity will likely range between 7-14 million tons by 2030—representing only 19-38% of the announced project pipeline.

Green vs. Grey Methanol

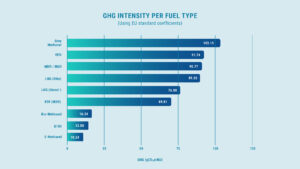

Not all methanol delivers the same environmental benefits, a crucial distinction often overlooked in sustainability discussions. Grey methanol, produced through steam reforming of natural gas, remains the dominant form in today’s market and contributes significantly to greenhouse gas emissions. Green methanol, conversely, is produced from renewable feedstocks such as captured CO₂ and green hydrogen from renewable energy sources, or from sustainable biomass.

The production process fundamentally determines the environmental impact. While grey methanol production emits large quantities of carbon dioxide, green methanol production is designed to convert waste carbon and renewable energy into fuel without adding new carbon to the atmosphere. This distinction becomes critical when evaluating true sustainability credentials, as switching to grey methanol may not deliver the expected environmental benefits.

Supply Chain Challenges in Traditional Yachting Regions

Infrastructure Limitations

The yachting industry faces unique challenges in accessing green methanol compared to commercial shipping. Unlike large container vessels that bunker at major commercial ports with established fuel infrastructure, yachts require small-scale distribution networks that currently don’t exist for methanol in traditional cruising areas. Unless there is demand from other industries for methanol to be supplied by truck, the small-scale distribution of methanol for yachting may never materialise to fuel methanol-powered yachts.

Regional Availability Gaps

Current methanol bunkering infrastructure focuses on major commercial shipping hubs, with limited availability in key yachting destinations across the Mediterranean, Caribbean, and other traditional cruising grounds. The shipping industry itself is experiencing significant supply chain disruptions, with major projects in China facing delays and unmet deliveries, shaking confidence among shipping companies and causing many to reconsider methanol-powered vessel investments.

Regulatory Landscape and Compliance Requirements

Emerging Maritime Regulations

The European Union’s FuelEU Maritime regulation, effective from January 2025, sets greenhouse gas intensity targets requiring a 2% reduction in 2025, escalating to 80% by 2050. This regulation emphasises a well-to-wake approach, requiring fuel suppliers to track and report emissions across the entire supply chain from production to bunkering.

For renewable fuels of non-biological origin (RFNBOs), suppliers must demonstrate at least 70% greenhouse gas emissions reduction against the Renewable Energy Directive and comply with specific renewable electricity sourcing rules. Biofuels must meet criteria ensuring minimum GHG emission savings, with all fuels from food or feed crops prohibited except those under specific exceptions.

Certification and Verification Challenges

The complexity of certification requirements creates additional barriers for green methanol adoption. Fuel suppliers must maintain rigorous documentation throughout the supply chain, with all relevant data verified by accredited third parties. This comprehensive tracking system, while essential for ensuring genuine sustainability benefits, adds complexity and cost to the supply chain that may further limit availability for smaller-scale yacht operations.

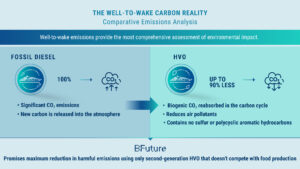

The Well-to-Wake Carbon Reality

Comparative Emissions Analysis

When evaluating alternative fuels, well-to-wake emissions provide the most comprehensive assessment of environmental impact. This methodology accounts for all emissions from fuel production through consumption, including upstream well-to-tank and downstream tank-to-wake emissions. For marine applications, this comprehensive analysis reveals significant differences between fuel options.

Hydrotreated Vegetable Oil (HVO) demonstrates proven well-to-wake carbon reductions of up to 90% compared to fossil diesel.

The CO₂ produced during HVO combustion is biogenic in origin and reabsorbed in the carbon cycle, unlike diesel, which adds “new” CO₂ to the atmosphere. Additionally, HVO reduces harmful local air pollutants, including particulate matter and nitrogen oxides, while containing no sulfur or polycyclic aromatic hydrocarbons.

Peninsula has been promoting HVO as “the most suitable transitional fuel for yachting for a number of years,” though uptake has been relatively limited as yacht owners seek proven performance data. Our BFuture HVO product promises maximum reduction in harmful emissions using only second-generation HVO that doesn’t compete with food production.

Performance Benefits Beyond Emissions

HVO offers practical advantages that extend beyond environmental benefits. The fuel provides higher energy content by mass and a higher Cetane Index compared to conventional diesel, potentially leading to reduced engine stress, lower operating temperatures, and more complete combustion. These characteristics can result in reduced carbon deposits, improved engine performance, and potentially extended engine life.

Current Market Dynamics and Future Outlook

Supply Chain Disruptions

The shipping industry’s experience with green methanol supply illustrates broader challenges facing the marine fuel transition. Production difficulties have plagued green methanol projects, particularly in China, leading to delays and unmet deliveries that have shaken confidence among shipping companies. This has prompted many to reconsider investments in methanol-powered vessels in favour of LNG-fueled alternatives.

The fundamental “chicken-and-egg dilemma” persists: fuel producers require long-term offtake commitments before ramping up production, while shipping companies remain reluctant to commit due to high prices driven by current scarcity. This mismatch between producer requirements and shipper willingness creates ongoing uncertainty in green fuel markets.

Economic Considerations

EU regulations are beginning to narrow the cost gap between conventional and alternative fuels through emissions trading systems and penalties for high-carbon fuels. The FuelEU Maritime regulation imposes escalating non-compliance costs from €39 per ton in 2025 to €1,997 per ton by 2050. Combined with EU ETS carbon pricing projected at €100 per ton, conventional fuels face additional costs of €321 per ton.

However, green methanol pricing remains significantly higher than conventional alternatives. Industry analysis forecasts average maximum prices for bio-methanol at €1,193 per ton from 2025-2050, with e-methanol prices estimated at €2,238 per ton from 2025-2033, decreasing to €1,325 per ton from 2034-2050.

Practical Pathways Forward

Immediate Solutions with Proven Impact

While the industry develops green methanol infrastructure, HVO presents an immediately available solution that can deliver substantial emissions reductions today. Unlike methanol, which requires significant engine modifications and specialised fuel systems, HVO serves as a drop-in replacement for conventional diesel, requiring no engine modifications.

The Cruising Association, Royal Yachting Association, British Marine, and Inland Waterways Association are actively campaigning to improve HVO availability and affordability for recreational vessels. Their efforts focus on extending UK government incentives under the Renewable Transport Fuel Obligation scheme to seagoing recreational vessels under 24 meters, which could significantly reduce costs and administrative complexities.

Strategic Fuel Planning

For yacht owners and operators, strategic fuel planning must consider both immediate needs and long-term sustainability goals. This includes evaluating the sustainability credentials of available fuels through certified supply chains and understanding the well-to-wake emissions profile of different options.

Conclusion: Navigating Reality While Supporting Innovation

The path to maritime decarbonisation requires an honest assessment of current capabilities alongside continued support for emerging technologies. While green methanol holds significant promise for long-term sustainability, the current reality of limited production capacity, supply chain challenges, and infrastructure gaps means that truly sustainable methanol remains largely inaccessible for most yacht operations.

Peninsula Yacht Services supports the development and eventual adoption of green methanol and other advanced alternative fuels. The immediate focus should be on proven solutions like second-generation HVO that can deliver substantial emissions reductions today while the industry continues developing next-generation fuel technologies.

The transition to sustainable yachting will require a portfolio approach, utilising available technologies while supporting innovation in emerging solutions. By understanding the current realities of green fuel availability and making informed choices about proven alternatives, the industry can achieve meaningful progress toward sustainability goals while maintaining operational excellence.

Our commitment remains to provide transparent, science-based guidance that enables yacht owners and operators to make informed decisions about their fuel choices. As the landscape continues evolving, we’ll continue monitoring developments and providing practical solutions that balance environmental responsibility with operational requirements.